In the realm of corporate finance, understanding assets and liabilities is fundamental to managing a company’s financial health and making informed business decisions. Assets represent what a company owns, while liabilities encompass what it owes. This blog explores the significance of corporate assets and liabilities, their types, and how businesses strike a balance to ensure long-term prosperity.

Defining Corporate Assets

Corporate assets encompass all the resources a company owns that have monetary value and contribute to its ability to generate revenue. These resources can be tangible or intangible and play a crucial role in the company’s operations and growth. Examples of corporate assets include:

- Tangible Assets: Physical assets such as property, equipment, machinery, inventory, and cash fall under this category.

- Intangible Assets: These are non-physical assets like intellectual property (patents, trademarks, copyrights), brand value, goodwill, and customer relationships.

- Financial Assets: Investments in stocks, bonds, and other securities held by the company.

- Accounts Receivable: The amount owed to the company by customers or clients for goods or services sold on credit.

The Significance of Corporate Assets

Corporate assets are the building blocks of a company’s financial stability and success. They serve several critical purposes:

- Generating Revenue: Assets like machinery, inventory, and intellectual property enable the company to produce and sell goods or services, generating revenue.

- Collateral for Financing: Tangible assets can serve as collateral when seeking financing from lenders, making it easier to secure loans.

- Enhancing Creditworthiness: A healthy asset base enhances the company’s creditworthiness and financial reputation.

- Attracting Investors: A strong portfolio of assets can attract investors looking for promising investment opportunities.

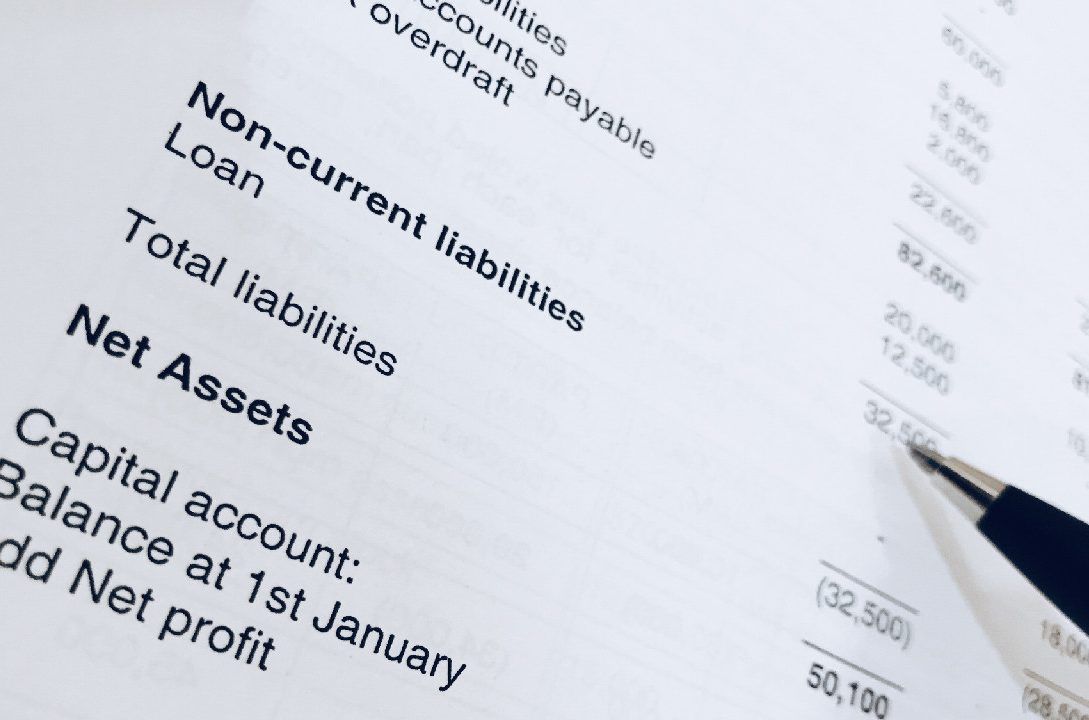

Understanding Corporate Liabilities

Corporate liabilities, on the other hand, represent the company’s financial obligations and debts to external parties. These obligations can arise from borrowing money, purchasing goods on credit, or other contractual commitments. Examples of corporate liabilities include:

- Short-term Liabilities: Obligations that the company must settle within a year, such as accounts payable, short-term loans, and current portions of long-term debt.

- Long-term Liabilities:Debts and obligations that are due beyond a year, including long-term loans and bonds.

- Accrued Liabilities: Expenses incurred but not yet paid, such as taxes, salaries, and interest.

Striking the Balance: Assets and Liabilities

Maintaining a healthy balance between assets and liabilities is crucial for a company’s financial well-being. This equilibrium is measured through two key financial metrics:

- Solvency: Solvency refers to a company’s ability to meet its long-term financial obligations. A company is considered solvent if its assets exceed its liabilities.

- Liquidity: Liquidity indicates a company’s ability to meet short-term financial obligations. Sufficient cash or liquid assets are necessary to cover immediate liabilities.

Conclusion

In the complex world of corporate finance, understanding the interplay between assets and liabilities is essential for running a successful business. Corporate assets represent the resources that enable revenue generation and business growth, while liabilities signify financial obligations that must be met. Striking a balance between the two is crucial for maintaining financial stability, attracting investors, and ensuring long-term prosperity. By carefully managing assets and liabilities, companies can navigate challenges, seize opportunities, and build a solid foundation for a thriving future.

Related Posts:

Get Started with a free 15 -day trial

No credit card required for Trial Plan

Continue using starter plan for free forever, after trial or upgrade to Premium Subscription